It also contributed to the growth of standalone products.

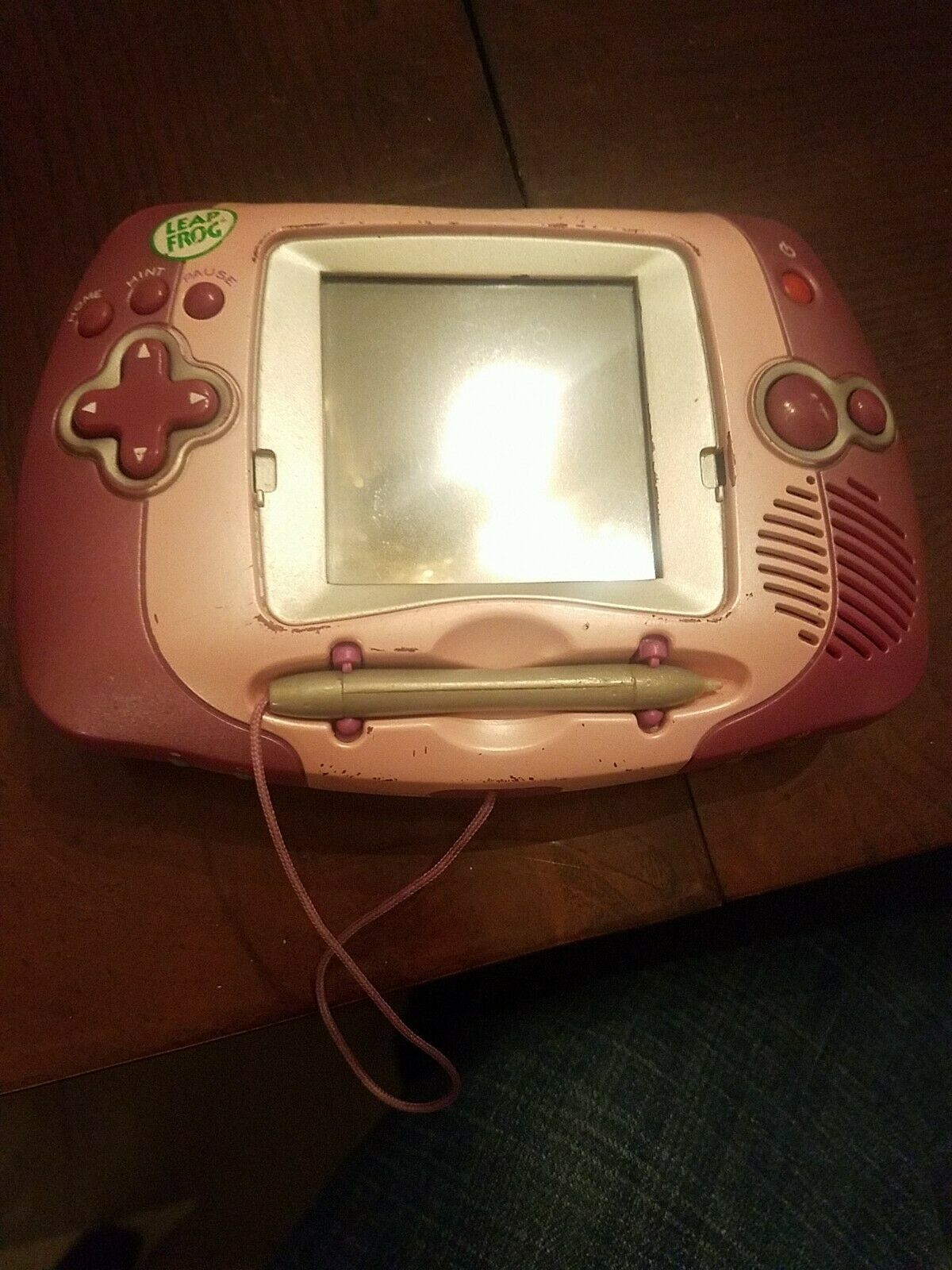

Go! Go! Smart Animals™, a brand new extension of the successful Go! Go! Smart Wheels line, reached US retailers' shelves in August 2014. The newly introduced Go! Go! Smart Wheels Ultimate Amazement Park playset was named one of the hottest holiday toys by US retailers, securing listings that include Walmart's "Chosen by Kids Top 20 Toy" and Target's "Top Toy". Standalone products continued to perform well during the period, led by core infant products and Go! Go! Smart Wheels ®, the line of smart infant vehicles and playsets. It is recommended in numerous top toy lists, including Walmart's "Chosen by Kids Top 20 Toy" list, Kmart's "Fab 15" list of hot holiday toys and Toy Insider's "Top Tech 12" list. It hit retailers' shelves in the US in July 2014 and sales have been strong. This is the world's first smartwatch for children with a built-in camera. In other platform categories, the handheld gaming console MobiGo ® is reaching the end of its product life cycle.Ĭontinuing its history of product innovation, VTech has successfully harnessed the latest technology trend in smartwatches for adults and brought it to children with the launch of Kidizoom Smartwatch. High channel inventory and increasing competition led to heavy discounting by retailers, resulting in price pressure and reduced shipments of tablets in the education aisle.

#MOBIGO 2 KMART PLUS#

VTech's fourth generation of children's educational tablets, InnoTab ® 3 PLUS and 3S PLUS, hit the shelves in August 2014. The children's tablet market in the US was difficult. Despite a challenging market, VTech became the number one manufacturer in the category of Infant and Preschool Electronic Learning in the US. The decline was attributable to lower sales of platform products, which was only partially offset by higher sales of standalone products. Despite the sales decline, North America remains the largest market for the Group, accounting for 50.0% of Group revenue.ĮLPs revenue in North America was US$141.2 million, a 10.5% decrease. This was mainly due to lower revenue from electronic learning products (ELPs) and contract manufacturing services (CMS). Group revenue in North America in the first six months of the financial year was US$450.6 million, down 1.1% over the same period last year. This was despite the fact that wages in China continued to rise, although the Renminbi weakened slightly against the US dollar. Labour costs and manufacturing overheads remained largely stable, as automation, process improvements and product optimisation continued to generate efficiency gains. Cost of materials was lower due to falling component prices. Allan Wong, Chairman and Group CEO of VTech Holdings Limited.Ĭost pressures eased slightly in the first half of the financial year 2015. The profit increase was due to an enhanced gross margin, as the Group benefited from lower cost of materials and an increase in the proportion of higher margin products in all three product lines," said Mr. Profit attributable to shareholders of the Company grew by 7.5%, despite revenue being broadly stable. "VTech delivered solid profit growth in the first half of the financial year 2015. The Board of Directors has declared an interim dividend of US17.0 cents per ordinary share, representing an increase of 6.3% over the same period last year. Basic earnings per share increased by 7.3% to US40.9 cents, compared to US38.1 cents in the corresponding period last year. The rise in profit was mainly attributable to an improved gross margin. Profit attributable to shareholders of the Company increased by 7.5% to US$102.7 million. This was primarily due to higher revenue in Europe and Asia Pacific, offsetting lower revenue in North America and Other Regions. Group revenue for the six months ended 30 September 2014 rose by 0.9% over the same period of the previous financial year to US$900.8 million. Hong Kong – VTech Holdings Limited (HKSE: 303) today announced its results for the six months ended 30 September 2014, reporting further profit growth on an improved gross margin.

Group revenue increased by 0.9% to US$900.8 million.Further Profit Growth on Enhanced Gross Margin

0 kommentar(er)

0 kommentar(er)